Are there any that aren’t being used at all? Any unused licenses? Duplicate subscriptions? Do you have similar services provided by more than one provider? Go through your logins and ask your employees to do the same. Look at all the recurring SAAS subscriptions your business pays for monthly. Ram Shengale, Founder of Fantastech Solutions This can help you save some good amount of money every single month that can help you save a few extra thousand dollars annually.

Lower monthly expenses free#

Or even better, switch to free alternatives if there’s one in the market. If you’re not using all of the features in a service, you can think of downgrading. My tip would be to audit the tools and services you use every 6 months and see if you’re actually using and benefiting from them. Using these tools and services is a great idea, but soon the amount of monthly recurring costs can increase and drain a good amount of money from your monthly budget. PAY OFF DEBTįinally, get rid of your debt! You will have a HUGE weight off your shoulders and reduce your monthly expenses.Nowadays most small businesses depend upon using online tools and services to manage their businesses and increase productivity. They shop the market to find you the best premiums. Insurance brokers work for you – not a particular insurance company.

Get in contact with an insurance broker if you are nervous about comparing prices alone. You can even look into options to bundle multiple insurance premiums like home and auto insurance. Taking the time to compare prices on insurance can greatly reduce your monthly expense. REDUCE INSURANCE PREMIUMSĪnother expense you need to shop around on is insurance.

Lower monthly expenses how to#

Many bad spending habits can be solved by simply planning, and meal preparation is one of them.ĭownload the free weekly meal planner and head here to learn more about how to meal plan. It is five times more expensive to eat out than to eat at home. Improving your basic household skills like food preparation and meal planning can have major savings! Of course, these all depend on your individual situation.

Lower monthly expenses full#

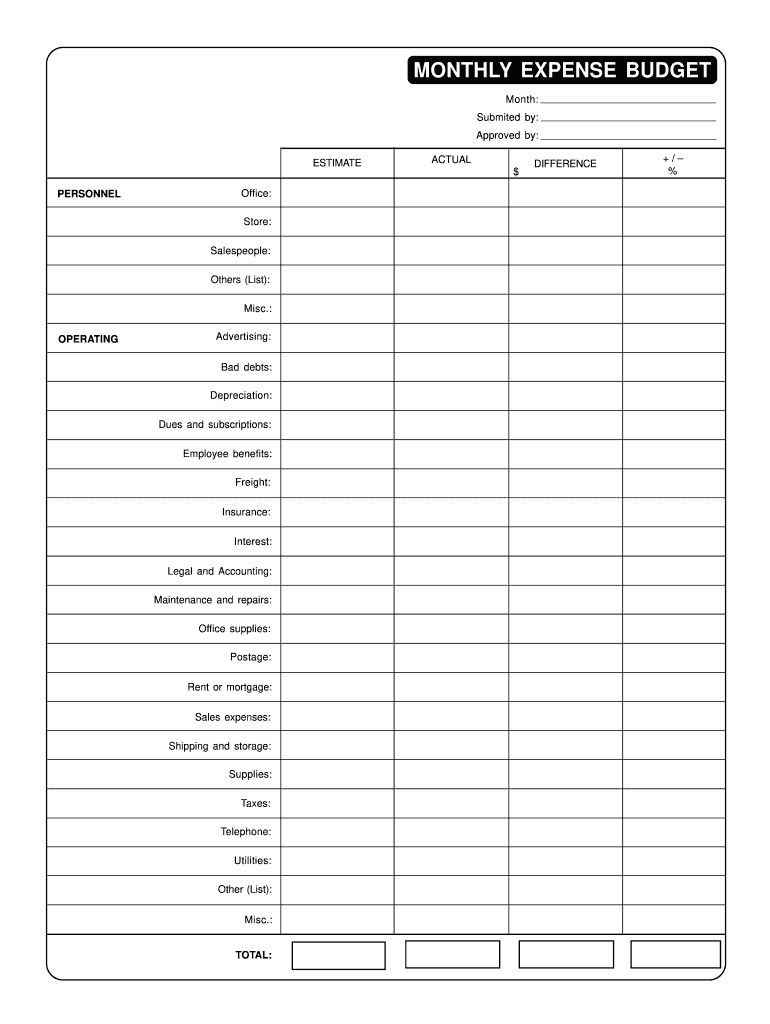

Starting a budget is the best way to track your spending. START A BUDGETįirst, before you can start cutting expenses, you need to have a road map. Here’s how to cut your monthly expenses… 1. Therefore, you have two options, get a bigger income or fewer expenses. If that income is completely tied up in monthly expenses then you won’t reach your goals very fast. Your income is the tool you need to get where you want to go. Whether you are saving for a financial goal, life change, or to pay off debt cutting back on monthly expenses will help!

0 kommentar(er)

0 kommentar(er)